Investigate the primary factors influencing expenditure in the building products sector.

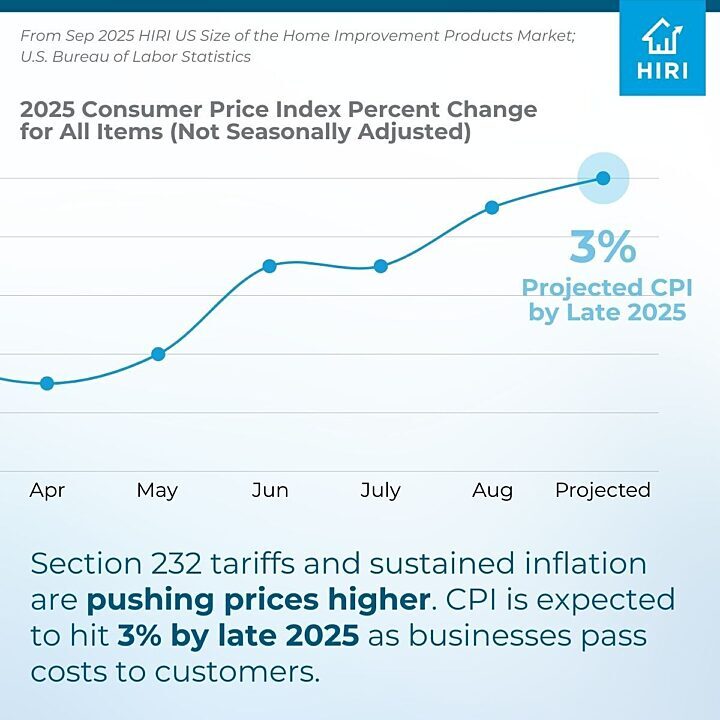

2.5% growth projected for 2025, revised down from 3.4% due to macroeconomic headwinds

The home improvement industry’s only product-focused size of market study provides data back to 1992 with 5‑year forecasts for the consumer and professional markets. Product category level detail is provided for the consumer market and new in 2018 for the professional market. Geographic detail is provided for the 9 Census divisions with annual estimates to the state level.

© 2025 Home Improvement Research Institute. All rights reserved.